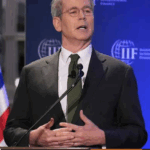

Bank of England Governor Andrew Bailey has expressed support for concerns raised by the Trump administration regarding global trade imbalances, acknowledging that the United States “has a point” in its criticism. Speaking at an event hosted by the Institute of International Finance in Washington, Bailey outlined the Bank’s ongoing efforts to assess the potential economic implications of rising tariffs and geopolitical tensions as part of preparations for the Bank’s interest rate decision in May.

Bailey’s remarks came during a crucial week of discussions organized by the International Monetary Fund (IMF), where global economic policies and imbalances were hot topics. His comments marked a notable shift in tone, aligning with concerns raised during the Trump administration about the structural risks posed by long-standing trade surpluses among major manufacturing exporters, particularly China.

“The system is not working properly, and Scott Bessent [US Treasury Secretary] has a point,” Bailey stated. He went on to explain that China’s reliance on export-led manufacturing and weak domestic demand was an unsustainable model in the long term. Bailey, an economic historian, drew parallels to the post-World War II Bretton Woods institutions, which were designed to address such global imbalances.

“The original Bretton Woods framework emphasized adjustment from deficit countries,” Bailey noted, highlighting how the US, once a surplus country, now finds itself in a different position. He suggested that there needs to be a return to “symmetrical adjustment” in global trade, with responsibilities shared across economies.

Bailey’s comments come in the wake of US Treasury Secretary Scott Bessent’s sharp critique of the IMF, accusing the institution of focusing too much on climate change and diversity issues while neglecting macroeconomic concerns. Bessent has also criticized China’s economic policies as “globally distortive.”

While Bailey defended the multilateral system as critical to global stability, he agreed with Bessent’s call for the IMF to focus on its core economic mission. He emphasized, however, that it was not the IMF’s role to regulate trade imbalances directly.

In Washington for the IMF and World Bank spring meetings, UK Chancellor Rachel Reeves echoed Bailey’s stance, signaling alignment with the US on addressing global trade imbalances. Reeves stated that the UK supports efforts to reduce tariff and non-tariff barriers to facilitate stronger trade relations with the US. However, she made it clear that the UK would not lower its domestic standards on food or vehicles in response to American demands.

IMF Managing Director Kristalina Georgieva has called for surplus economies to adjust their policies and has promised to sharpen the IMF’s focus on addressing global imbalances. Despite this, there are concerns that renewed US scrutiny of multilateral institutions could undermine programs focused on climate change and gender equity.

Bailey concluded by acknowledging that while the Bretton Woods system has endured for 80 years, the current challenges require reflection on how international financial institutions are structured and how they can adapt to contemporary economic needs.